Sustainia Simplifies

ESRS - the latest

ESRS – the latest developments

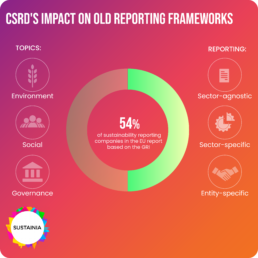

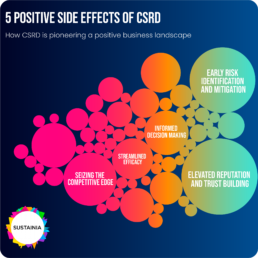

The European Commission’s adoption of the final European Sustainability Reporting Standards (ESRS) for companies under the Corporate Sustainability Reporting Directive (CSRD) represents a significant leap towards a sustainable EU economy. As these standards materialize, they bring forth defining changes that will redefine sustainability reporting practices across the continent.

Disclosures

The ESRS underwent a transformative refinement, resulting in a noteworthy change from their pre-consultation period form. Initially, all draft ESRS were mandatory, but the European Commission has now introduced a more flexible approach. While ESRS 2 retains “mandatory disclosures” on issues not subject to materiality assessments, such as governance models, materiality assessment outcomes and impact, risk and opportunity management, other disclosures in topical standards are subject to double materiality assessments.

Corporations must report on issues deemed material to their operations while providing detailed explainers for immaterial topics. According to the European Commission, this affords companies greater flexibility to determine the relevance of information, thus avoiding unnecessary reporting costs and ensuring focused disclosures according to corporations’ specific value chains (considering upstream and downstream activities).

Double Materiality

A central aspect of reporting lies in the double materiality assessment, which mandates companies to examine topical issues using the Impact materiality (Inside-Out) and financial materiality (Outside-In) perspectives. Although this rigorous assessment enhances transparency, the challenge of considering issues to be immaterial is evident, particularly when addressing concerns like forward-looking information.

Explaining why certain issues have been omitted will be onerous if they will prove material in the future. Moreover, it could be argued that talks of higher costs associated with extensive assessments and reporting are exaggerated because double materiality assessments are subject to third-party assurance checks. In the event that certain omitted topical standards are found to be material, it could lead to more costs in the long run.

Alignment with Global Standards and Interoperability

The standards consider discussions with the International Sustainability Standards Board (ISSB) on financial materiality and the Global Reporting Initiative (GRI) for impact materiality. This harmonization fosters high interoperability between EU and global standards, preventing unnecessary double reporting and facilitating a path toward worldwide standardization and comparability of sustainability reporting. Corporations operating in the EU but headquartered outside the region, required to comply with the CSRD from 2028/2029, will benefit greatly from this cohesive approach.

Phase-Ins

Recognizing the varying capacities of companies, particularly smaller ones, the ESRS introduces phase-ins for specific disclosures. According to the Commission, providing additional time and spreading initial costs ensures higher-quality reporting for companies with fewer than 750 employees. Certain reporting requirements on biodiversity and social issues are among those phased in, which aims to strike a balance between practicality and urgency.

Looking Forward

As we assess the final ESRS drafts, considerations arise regarding their sustainability and efficacy. While the regulatory backing compelling over 50,000 corporations to address sustainability issues is commendable, some concerns persist. Non-mandatory climate-related, and environmental disclosures may not measure up to the ambitious EU Green Deal’s objectives.

In 2020, about 78% of Europe’s largest companies fell short of reporting environmental and climate-related risks despite EU guidelines. Making climate-related and other environmental disclosures non-mandatory will certainly not do the planet any good. For instance, there are about 15 categories of scope 3 GHG emissions, ranging from employee commuting to transportation of goods and services, and these affect virtually all large corporations. Moreover, the implications of phase-ins on matters of utmost importance, like biodiversity conservation, warrant careful attention. Corporations must not, in the slightest, be fed the idea that such issues are secondary, especially if they are actually material to their operations.

In due course, the degree of corporate compliance with the ESRS remains a crucial factor that will ultimately define the success of this transformative regulation.